Railway Stocks Surge After Fare Hike: Why RVNL, IRFC, IRCTC, RailTel & IRCON Are Rising?

Team Sahi

Railway stocks are back in momentum ,and this time, the trigger is not just hope.

It’s hard cash flow.

From December 26, 2025, Indian Railways has officially implemented revised passenger fares, a rare but structurally important move that directly improves the revenue visibility of India’s largest public transport network. The market responded instantly ,with PSU railway stocks rallying up to 10% in a single session.

Names like RVNL, IRFC, IRCTC, IRCON and RailTel saw aggressive buying as investors began repricing the sector for higher sustainable earnings, not just government capex hope.

Let’s decode what changed, why this matters, and what it could mean for railway stocks in 2026.

What Changed in Indian Railways Fare Structure?

For the first time in years, Indian Railways has rationalised passenger fares across long-distance routes.

| Category | Fare Increase |

|---|---|

| Ordinary Class | +1 paisa per km |

| Mail / Express | +2 paise per km |

| Applicability | Journeys over 215 km |

| Exclusions | Suburban routes, monthly season tickets |

While the hike looks small on paper, the volume math changes everything.

Estimated revenue impact:

- ₹600 crore additional revenue in the remaining FY26 period

- ₹2,400 crore annually once fully reflected

This creates a structural uplift in operating cash flows, helping Indian Railways absorb rising fuel, wage and maintenance costs while improving the credit profile of railway financing entities like IRFC.

Why Railway Stocks Are Rerating Now

The market is not reacting to speculation, it's reacting to visible earnings improvement.

Higher passenger fares mean:

- Better profitability for Indian Railways

- Higher lease rental and interest visibility for IRFC

- Faster execution, more tenders and stronger order pipelines for RVNL & IRCON

- Stable tech and telecom expansion budgets benefiting RailTel

- Stronger service margins for IRCTC

In short cash flow improves across the entire railway ecosystem.

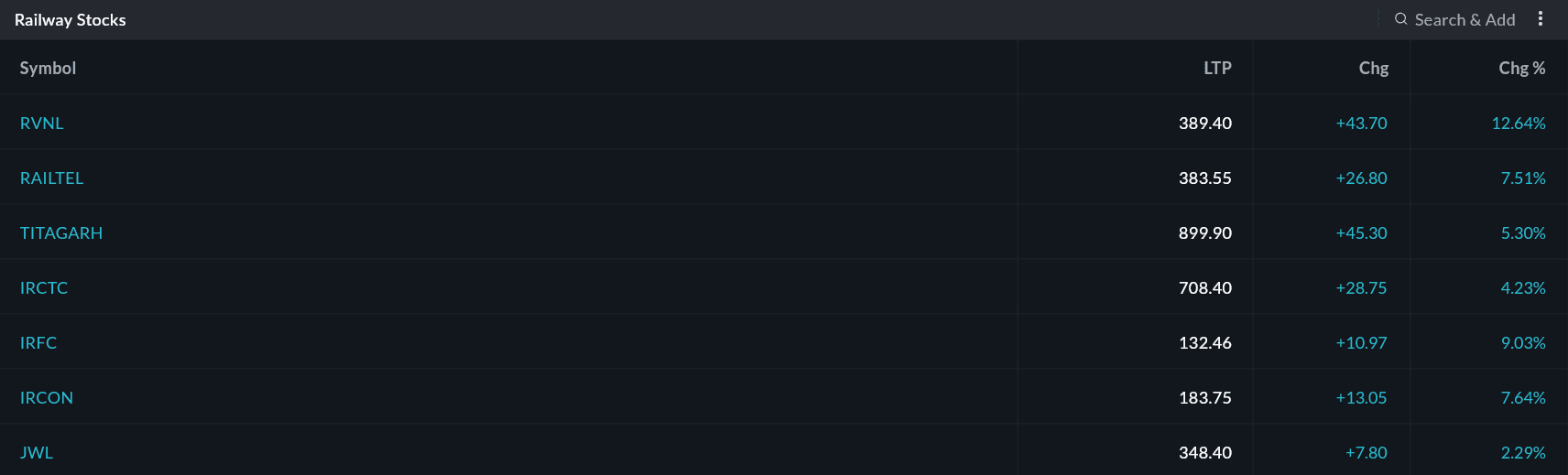

Today’s Stock Market Reaction (As of 12pm on December 26)

Several stocks are now extending a multi-day rally, trimming losses from earlier corrections.

The Pre-Budget Capex Layer Adds Fuel

Another major tailwind is the Union Budget 2026–27 positioning.

The street is building in:

- Higher railway capex allocations

- Fresh station redevelopment tenders

- Rolling stock & signaling upgrades

- Safety, electrification and digital rail projects

This makes railway PSUs a rare combination of:

- Improving cash flows

- Visible government spending

- Strong order books

- Low debt stress

But Aren’t These Stocks Already Expensive?

Interestingly most railway stocks are still trading below their 52-week highs.

Meaning:

- The rally is valuation-recovery driven, not bubble driven

- Earnings visibility has improved faster than prices

- Long-term investors are repositioning ahead of FY27 earnings cycles

What This Means for 2026

Indian Railways has quietly taken its first big step toward financial self-sustainability and the stock market noticed.

Fare hikes may look small ;but financially, they reset:

- Cash flow assumptions

- Capex funding comfort

- Credit quality of railway PSUs

- Long-term valuation multiples

And that’s why railway stocks are suddenly in leadership again.

This rally is not just about optimism.

It’s about visible cash, predictable revenue, and structural improvement the exact ingredients long-term markets love.

Railway stocks are no longer just a “budget theme”.They’re becoming earnings stories again.

Related

Recent

Adani Ports Q3 FY26 results: Volumes, logistics, and performance overview

NSE IPO: What We Know So Far About India’s Most Anticipated Listing

India–US Trade Deal 2026: A New Chapter in Global Commerce

The STT Change Explained: Why a Small Charge Ends Up Costing Traders Much More

Why Indian Defence Stocks are Falling After Budget 2026 — Despite Higher Spending