🚨 Nifty50 recovery hits a wall: OI cues, what lies ahead? HDFC AMC surges 7% & Stocks in focus inside!

Team SAHI

Market Today: A volatile day, what’s next?

The Nifty slipped early, tested the 25,700 zone, and clawed its way back to hold above the crucial 25,800 mark. Market breadth leaned negative, with the NSE A/D ratio at 2:3. Midcaps and Smallcaps, however, quietly outperformed.

From a forward-looking lens, the tone remains mildly cautious. There’s a visible cluster of resistance overhead for the Nifty, Bank Nifty, and Sensex, making upside progress harder for now. Bank Nifty’s key support sits around the 58,650–58,800 zone, and a decisive break below could invite sharper selling.

Key Levels to Watch: December 19, 2025

| Index | Support | Resistance |

|---|---|---|

| Nifty | 25,780 & 25,700 | 25,880 & 25,950 |

| Bank Nifty | 58,800 & 58,650 | 59,150 & 59,250 |

| Sensex | 84,220 & 84,000 | 84,750 & 85,050 |

Sector & Stock Moves: Where was the action?

IT stocks played the role of quiet anchors ahead of Accenture’s Q1 results. Realty and Metals also found buyers, as Hindustan Zinc extended its rally with record-high Silver prices.

Aviation and Financials added optimism to the session, with IndiGo rising after its CEO’s reassuring outlook, while Asset Management stocks rallied following SEBI’s ease in mutual fund fee rules, pushing HDFC AMC higher.

Healthcare remained mixed: Max Healthcare gained 1.69% on expansion and acquisition plans, while Sun Pharma slipped 2.62% after a US FDA setback. Among standout movers, Meesho jumped 8.89% as its market cap crossed ₹1 lakh crore, and Ola Electric dropped 4.98% after fresh promoter selling.

NIFTY50 Movers

Top Gainers

| INDIGO | +2.71% |

| TCS | +1.96% |

| MAXHEALTH | +1.69% |

Top Losers

| SUNPHARMA | -2.62% |

| TATASTEEL | -1.30% |

| POWERGRID | -1.21% |

Open Interest Insights

What does this mean? The setup reflects cautious participation from both sides, with downside gradually protected but no strong bullish conviction yet.

Stocks on the Move

| Stock | % Gain / Loss | What’s Happening? |

|---|---|---|

| HDFC AMC | +7.15% | Double bottom breakout above 20 & 50 EMAs with strong volume |

| HINDCOPPER | +5.23% | Bounce after successful re-test of the 365 breakout zone |

| M&M FIN | +3.82% | Clean consolidation breakout with momentum intact |

| TCS | +1.96% | Contracting pattern breakout; resistance near 3,338 |

| CUMMINSIND | -2.82% | Breakdown below key pivot; supports at 4,315 & 4,220 |

News You Can Use

- ACME Solar secures ₹4,725 crore financing, expands banking base.

- ICICI Bank receives ₹238 crore tax demand from Mumbai CGST authority.

- Ola Electric: Bhavish Aggarwal sells additional shares via open market.

- Sun Pharma slips after US FDA flags its Baska facility.

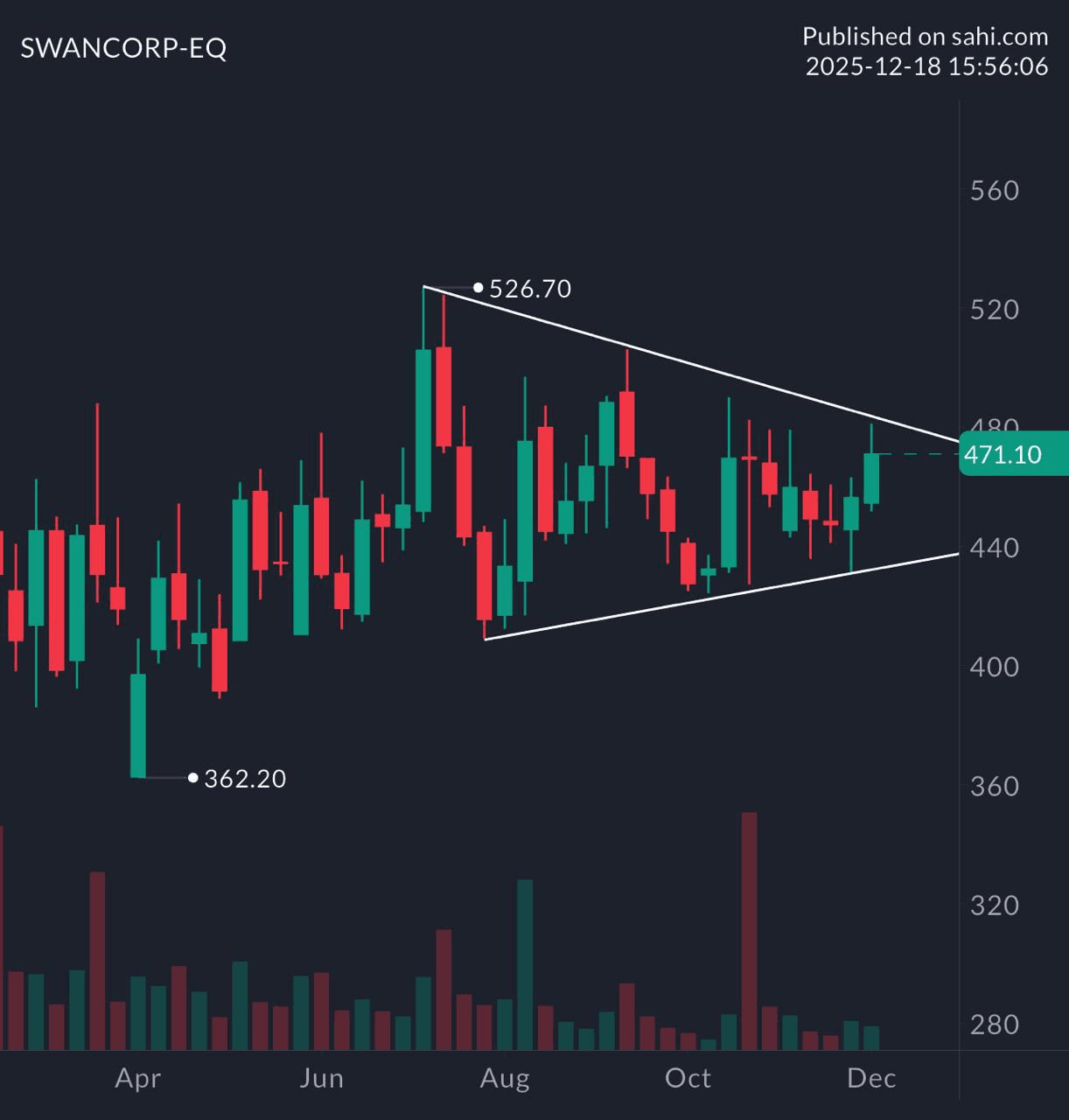

Chart of the Day: SWANCORP (Weekly)

Pattern: Symmetrical Triangle

Structure: Price compresses between converging trendlines, signalling balance and indecision.

Validation: A decisive breakout with volume confirms momentum.

Trading Insight: Breakouts often trigger strong moves in the dominant trend’s direction.

Related

Recent

Adani Ports Q3 FY26 results: Volumes, logistics, and performance overview

NSE IPO: What We Know So Far About India’s Most Anticipated Listing

India–US Trade Deal 2026: A New Chapter in Global Commerce

The STT Change Explained: Why a Small Charge Ends Up Costing Traders Much More

Why Indian Defence Stocks are Falling After Budget 2026 — Despite Higher Spending