Nifty Holds 26,100 After Recovery From Lows; Titan Jumps on Strong Q3

Team SAHI

Sensex: 84,961.14 ▼ -0.12%

Bank Nifty: 59,990.85 ▼ -0.21%

Market Today: Indecision on charts, what’s next?

Markets recovered from intraday lows to end largely flat. Nifty stabilised as IT stocks offered support, while broader markets outperformed. Bank Nifty lagged and closed lower, weighed down by HDFC Bank.

Nifty tested its 50-DEMA near 26,080 and formed another indecisive candle. The 26,080–26,000 zone now acts as an important support band. Bank Nifty continues to hold above 59,800, with 59,500 as the next support. Sensex found support near its 50-DEMA around 84,600, while 85,250 remains the immediate resistance.

Key Levels to Watch | January 08, 2026

| Index | Support | Resistance |

|---|---|---|

| Nifty | 26,080 & 26,000 | 26,225 & 26,335 |

| Bank Nifty | 59,800 & 59,500 | 60,250 & 60,450 |

| Sensex | 84,600 & 84,400 | 85,250 & 85,550 |

Sector & Stock Moves: Where was the action?

- IT stocks supported the benchmarks, while Autos saw profit booking

- Cipla slipped after its partner received US FDA observations

- Maruti Suzuki corrected from record highs; Tata Motors PV fell 1.5%

- Auto ER&D stocks rallied on positive brokerage views

- Jewellery stocks surged on upbeat Q3 updates, led by Titan

- IEX gained ahead of the market coupling case hearing

NIFTY50: Top Movers

| Gainers | Losers |

|---|---|

| TITAN +3.93% | CIPLA -4.11% |

| WIPRO +1.96% | MARUTI -2.79% |

| HCLTECH +1.94% | POWERGRID -1.66% |

Open Interest Insight

Put writing at 26,000 (20.79L) and 26,100 (39.69L) is helping form a near-term base, while aggressive call writing at 26,200 (48.94L) signals strong supply. PCR-OI remains near 0.7.

Implication: Downside appears supported, but the upside is capped, pointing to a range-bound to mildly bearish setup unless call writing unwinds.

Stocks on the Move

| Stock | % Move | What’s happening |

|---|---|---|

| TATAELXSI | +9.50% | IH&S breakout backed by strong long OI build-up |

| TATATECH | +5.29% | Clear double-bottom breakout with high volumes |

| PERSISTENT | +4.23% | Trading near upper consolidation band; breakout above 6,600 awaited |

| IEX | +4.11% | Breakout above 152, aligning with 50 EMA and volume support |

| CIPLA | -4.11% | Breakdown below 1,485 with strong selling volume |

News You Can Use

- HDFC Bank sees a block deal of ₹1,756 crore at ₹950 per share

- Info Edge Q3 standalone billings rise 11.8% YoY to ₹747.2 crore

- Jubilant FoodWorks Q3 revenue grows 13.4% YoY

- Titan reports a 40% jump in Q3 sales on festive demand

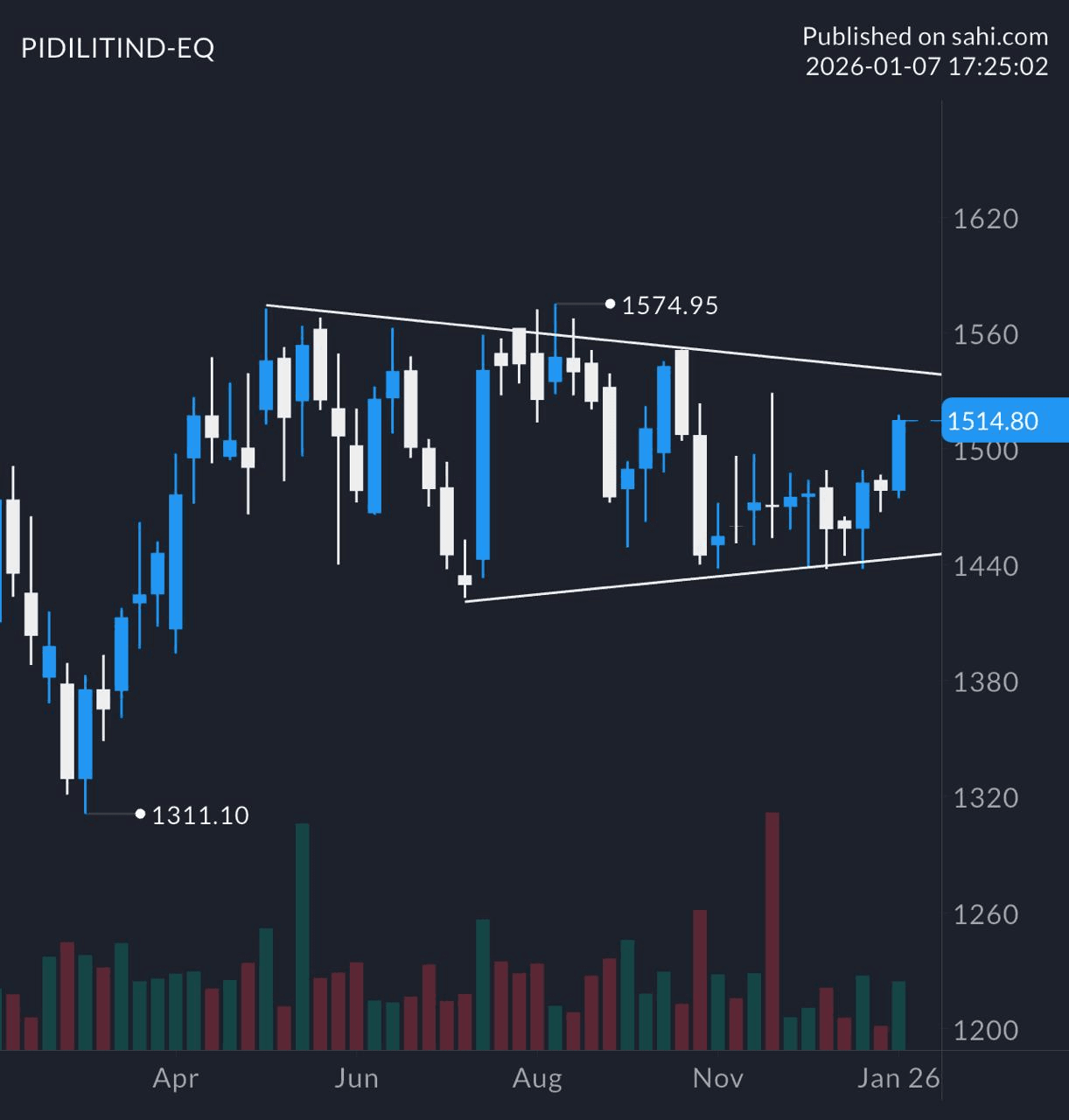

Chart of the Day: PIDILITIND (Weekly)

Pattern: Symmetrical Triangle

- Structure: Converging lower highs and higher lows show balance

- Validation: Breakout beyond the boundary with volume confirms direction

- Insight: Often leads to a strong continuation move post-breakout

Related

Recent

Adani Ports Q3 FY26 results: Volumes, logistics, and performance overview

NSE IPO: What We Know So Far About India’s Most Anticipated Listing

India–US Trade Deal 2026: A New Chapter in Global Commerce

The STT Change Explained: Why a Small Charge Ends Up Costing Traders Much More

Why Indian Defence Stocks are Falling After Budget 2026 — Despite Higher Spending