Market Today: Nifty Slips Below 26,150 as Indices End Weak

Team SAHI

Market Today: Nifty50 Slips Below 26,150

Markets failed to sustain early gains and ended near the day’s low, with Nifty closing below 26,150. Persistent selling in Reliance Industries and IT stocks weighed on the indices.

Nifty struggled around the 26,235–26,250 zone and is now trading near the hourly 20 EMA. Bank Nifty faced repeated rejection at 59,500, while Sensex weakness points toward 85,050 as a potential support. India VIX closed at a record low of 9.2, indicating muted volatility expectations.

Key Levels to Watch | December 26, 2025

| Index | Support | Resistance |

|---|---|---|

| Nifty | 26,050 & 25,950 | 26,235 & 26,325 |

| Bank Nifty | 59,020 & 58,850 | 59,250 & 59,500 |

| Sensex | 85,050 & 84,850 | 85,600 & 85,800 |

Sector & Stock Moves

IT, Pharma, and PSU Banks led the losses. IT stocks extended declines after changes to the US H-1B visa selection process. Coforge fell 5.92% over two sessions ahead of a board meeting on fundraising.

Manappuram Finance gained tracking rising gold prices, while Hindustan Zinc and Hindustan Copper benefited from record-high silver and copper prices. Castrol India rose after BP agreed to sell a majority stake in its parent entity, and Ajanta Pharma advanced following an in-licensing deal with Biocon.

NIFTY50: Top Gainers

- TRENT ▲ +2.39%

- SHRIRAMFIN ▲ +1.66%

- APOLLOHOSP ▲ +1.39%

NIFTY50: Top Losers

- INDIGO ▼ -1.46%

- DRREDDY ▼ -1.38%

- WIPRO ▼ -1.23%

Open Interest Insights

Heavy call writing is concentrated at 26,200 (62.49L) and 26,300 (43.59L), marking a clear resistance area. On the put side, activity is modest at 26,000 (34.3L), keeping the PCR-OI near neutral at 0.9.

What does this mean? Expect Nifty to face supply pressure, while downside protection is limited. Overall, sentiment is neutral, indicating range-bound action until a decisive move occurs.Stocks on the Move

| Stock | % Gain / Loss | What’s Happening |

|---|---|---|

| HINDCOPPER | +7.05% | Copper prices hit a five-month high, lifting metal stocks |

| MANAPPURAM | +6.70% | Rounding base breakout confirmed; support near 305 |

| PNBHOUSING | +3.59% | Parallel channel breakout; resistance near 975 |

| ATHERENERG | +2.18% | Contracting pattern breakout with rising volumes |

| HFCL | -3.05% | Trading below key moving averages; RSI weakening |

News You Can Use

- HFCL raises ₹5.50 billion through a QIP issue.

- BP agrees to sell a 65% stake in Castrol India, with proceeds estimated at $6 billion.

- Crompton bags a ₹46 crore order from MSEDCL.

- DRDO successfully conducts trials of the Akash-NG missile system.

- L&T wins a metro railway project order from MMRDA.

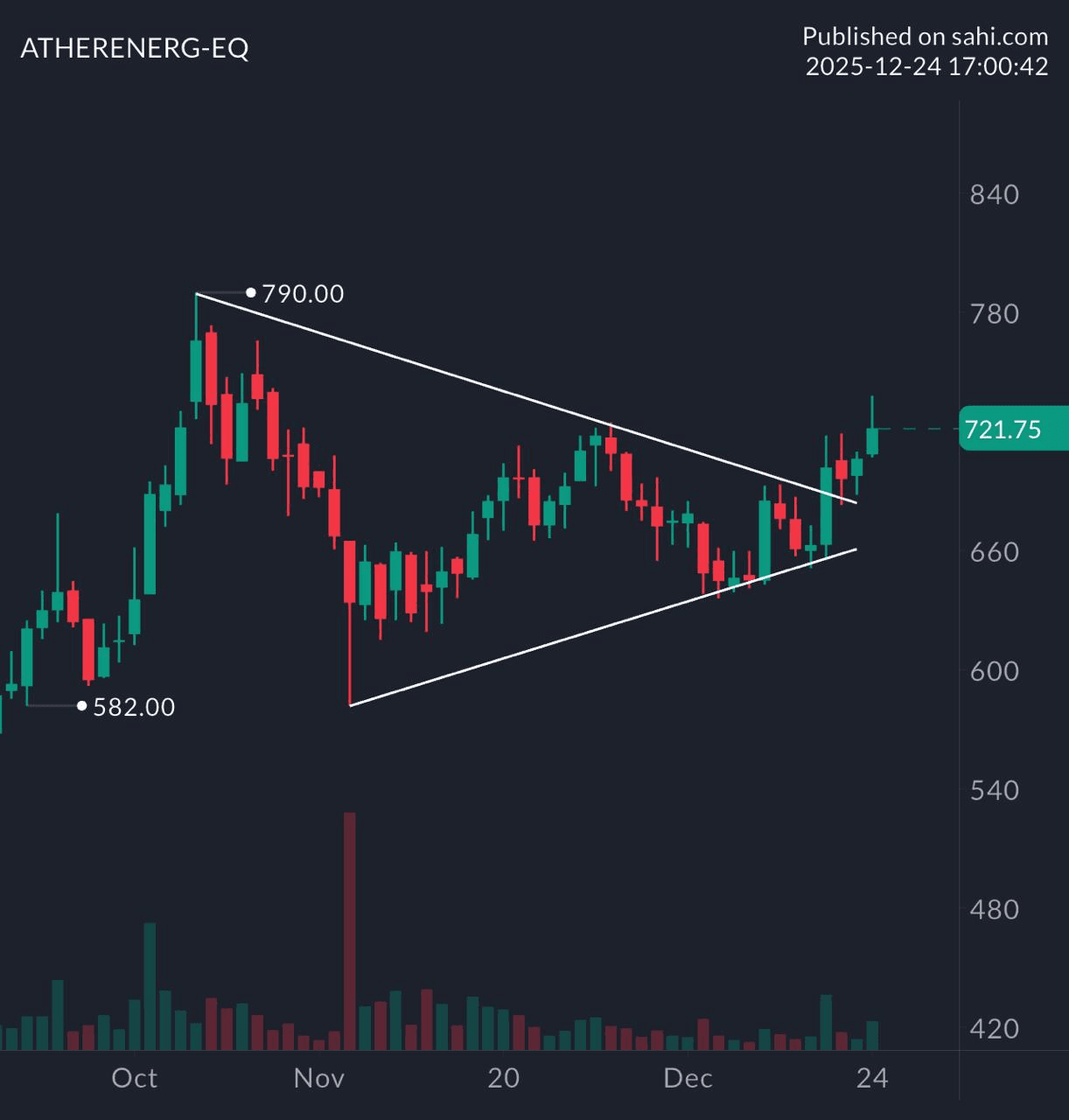

Chart of the Day: ATHERENERG (Daily)

Pattern: Symmetrical Triangle

Structure: Price compresses within converging trendlines marked by LHs and HLs, signalling balance and indecision after a directional move.

Validation: A breakout beyond either trendline, supported by expanding volumes.

Trading Insight: A continuation setup where the eventual breakout often triggers a strong move in the direction of the dominant trend.

Related

Recent

Adani Ports Q3 FY26 results: Volumes, logistics, and performance overview

NSE IPO: What We Know So Far About India’s Most Anticipated Listing

India–US Trade Deal 2026: A New Chapter in Global Commerce

The STT Change Explained: Why a Small Charge Ends Up Costing Traders Much More

Why Indian Defence Stocks are Falling After Budget 2026 — Despite Higher Spending